Blog

What is Slippage?

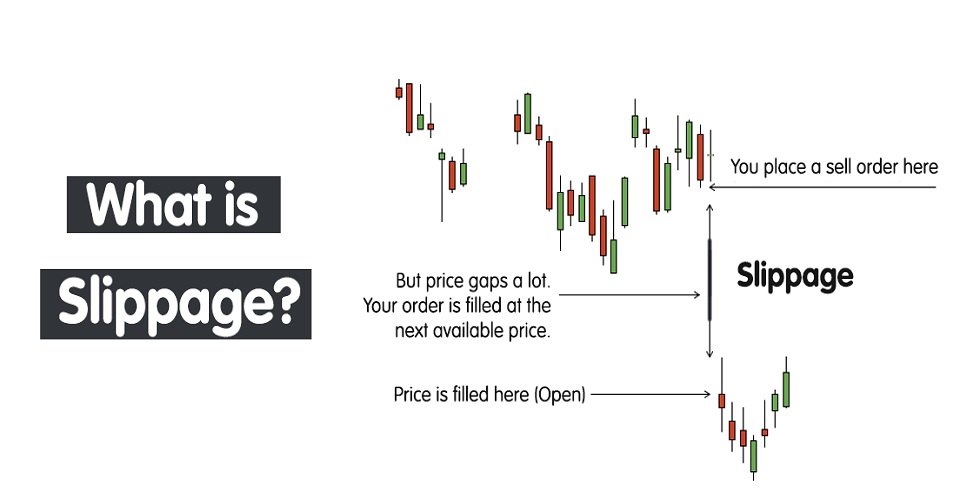

Slippage is a term that is used quite often in the world of financial trading. Slippage is basically the difference between the expected price of a trade, and the actual price that it is executed at. This phenomenon occurs during periods of high volatility as well as when there are large orders placed when the buying interest is rather low.

There are two types of slippage; positive and negative. A positive slippage takes place when an order is executed at a price which is better than what was expected. Conversely, a negative slippage refers to a situation where an order gets executed at a lower price than what was originally expected.

Since the price movements are so quick and fast paced, slippage tends to occur as a result of the delay that exists between the point where one places the order, until it gets completed. Also, slippage can occur should a trade order gets executed without a limit order, or should a stop loss have been placed at a lower rate than what was set for the original order. Slippage, as noted earlier, takes place during periods when volatility levels are high. Often it is practically impossible to execute trades at the expected prices. In the case of forex, slippage results due to a change in the spread, that is the difference between the ask price and the bid price of an asset.

As a trader you need to make sure that the effects of a slippage are minimised as much as possible. While it is almost impossible to try to avoid the spread that will crop up between the entry and exit points, you can at least try to reduce it as much as you can. To do so you can try to change the type of market orders by opting for limit orders as the latter are ideal considering that they will only be filled at the price that you determine. Another good idea to reduce the effects of slippage is to avoid trading when there are major economic events taking place. If you notice market-moving news, then be extra careful as volatility will increase, and so will the price movements.

It is best to aim trading during periods of low volatility and when the markets are quite liquid. During these periods smooth price actions are typical and so you will not need to worry about erratic price changes. Besides, if the markets are highly liquid, you can expect that there are going to be active participants, both as buyers and sellers. So the chance of having an order being executed at the price you desire, are going to be higher.

It is also a good idea to make use of a virtual private server (VPS). This helps traders to benefit from the best execution time even if there are any technical problems, such as low internet connectivity, computer failures or a power cut.

At the end of the day, slippage is rather unavoidable. Hence, as a trader you will need to factor it in your decisions, as well as bear it in mind when setting up your trading plan. By using the above mentioned methods, you can however reduce its impact considerably.

There are two types of slippage; positive and negative. A positive slippage takes place when an order is executed at a price which is better than what was expected. Conversely, a negative slippage refers to a situation where an order gets executed at a lower price than what was originally expected.

Since the price movements are so quick and fast paced, slippage tends to occur as a result of the delay that exists between the point where one places the order, until it gets completed. Also, slippage can occur should a trade order gets executed without a limit order, or should a stop loss have been placed at a lower rate than what was set for the original order. Slippage, as noted earlier, takes place during periods when volatility levels are high. Often it is practically impossible to execute trades at the expected prices. In the case of forex, slippage results due to a change in the spread, that is the difference between the ask price and the bid price of an asset.

As a trader you need to make sure that the effects of a slippage are minimised as much as possible. While it is almost impossible to try to avoid the spread that will crop up between the entry and exit points, you can at least try to reduce it as much as you can. To do so you can try to change the type of market orders by opting for limit orders as the latter are ideal considering that they will only be filled at the price that you determine. Another good idea to reduce the effects of slippage is to avoid trading when there are major economic events taking place. If you notice market-moving news, then be extra careful as volatility will increase, and so will the price movements.

It is best to aim trading during periods of low volatility and when the markets are quite liquid. During these periods smooth price actions are typical and so you will not need to worry about erratic price changes. Besides, if the markets are highly liquid, you can expect that there are going to be active participants, both as buyers and sellers. So the chance of having an order being executed at the price you desire, are going to be higher.

It is also a good idea to make use of a virtual private server (VPS). This helps traders to benefit from the best execution time even if there are any technical problems, such as low internet connectivity, computer failures or a power cut.

At the end of the day, slippage is rather unavoidable. Hence, as a trader you will need to factor it in your decisions, as well as bear it in mind when setting up your trading plan. By using the above mentioned methods, you can however reduce its impact considerably.