Blog

What is a Market Cycle?

Did you ever hear of market cycles?

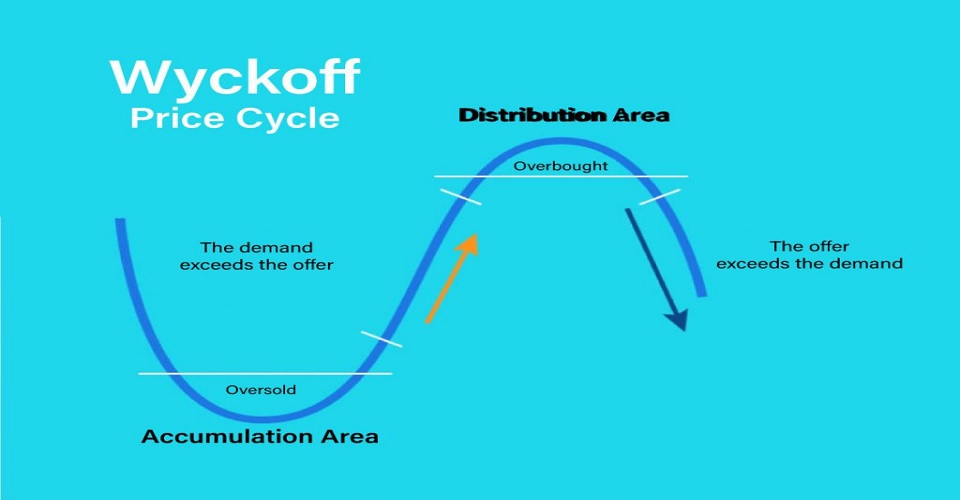

From evaluations of technical analysis one can notice that there are repetitive cycles occurring, mainly driven by the market moves that are made by large institutional investors. As a trader it is important to take notice of these market cycles as they can impact trades.

Market cycles are divided in different phases, namely:

- Expansion or Accumulation

- Peak or Markup

- Contraction or Distribution

- Trough or Markdown

These four cycle phases are like business cycles. Let us discuss each one of them in some more detail.

1. The Expansion phase takes place due to economic growth. It leads to a bull market as investors want to buy.

2. The Peak phase is when the pressure to buy reaches a peak, thus the name. At this point investors do not want to buy highly priced assets any longer.

3. The Contraction phase refers to the phase when the market starts to weaken. It moves from the peak point to the trough. This period is often referred to more commonly as a market recession.

4. The Trough is when the market has reached the lowest possible point, and then it will start to move forward to the expansion phase so that the market cycle kicks off again.

Now that you should have a clearer idea what the market cycles consist of you may be wondering what are the factors that lead to such phases. The main ones are macroeconomic factors, such as interest rates, inflation and unemployment levels. For instance impending rises in interest rates, and high levels of unemployment pinpoint economic slowdown, and vice versa. The market sentiment is also another key reason behind market cycles. During a boom period there will be many investors looking to buy certain assets, for instance.

Market cycles have an effect on asset valuations. Traders should keep an eye on market cycles so as to make wise decisions. Many traders make use of the Elliott wave principle when trading. This is a type of technical analysis that helps to analyse market cycles. High and low points in asset prices can be forecasted and so are trends.

It is important to point out that the length of market cycles varies. A cycle could last several weeks, or even a number of years. Economic factors play a role in this. Trying to understand market cycles is important for traders so that decisions can be made accordingly.

From evaluations of technical analysis one can notice that there are repetitive cycles occurring, mainly driven by the market moves that are made by large institutional investors. As a trader it is important to take notice of these market cycles as they can impact trades.

Market cycles are divided in different phases, namely:

- Expansion or Accumulation

- Peak or Markup

- Contraction or Distribution

- Trough or Markdown

These four cycle phases are like business cycles. Let us discuss each one of them in some more detail.

1. The Expansion phase takes place due to economic growth. It leads to a bull market as investors want to buy.

2. The Peak phase is when the pressure to buy reaches a peak, thus the name. At this point investors do not want to buy highly priced assets any longer.

3. The Contraction phase refers to the phase when the market starts to weaken. It moves from the peak point to the trough. This period is often referred to more commonly as a market recession.

4. The Trough is when the market has reached the lowest possible point, and then it will start to move forward to the expansion phase so that the market cycle kicks off again.

Now that you should have a clearer idea what the market cycles consist of you may be wondering what are the factors that lead to such phases. The main ones are macroeconomic factors, such as interest rates, inflation and unemployment levels. For instance impending rises in interest rates, and high levels of unemployment pinpoint economic slowdown, and vice versa. The market sentiment is also another key reason behind market cycles. During a boom period there will be many investors looking to buy certain assets, for instance.

Market cycles have an effect on asset valuations. Traders should keep an eye on market cycles so as to make wise decisions. Many traders make use of the Elliott wave principle when trading. This is a type of technical analysis that helps to analyse market cycles. High and low points in asset prices can be forecasted and so are trends.

It is important to point out that the length of market cycles varies. A cycle could last several weeks, or even a number of years. Economic factors play a role in this. Trying to understand market cycles is important for traders so that decisions can be made accordingly.