Blog

What is a Pip in Forex?

The word Pip comes from "point in percentage". Basically it is a measure of the smallest movement that can take place in the exchange rate. This standardised unit of measure is used in forex trading and traders rely a great deal on it since they can evaluate price movements with it.

Hence the pip is the smallest increment in price at which a currency pair moves. The pip is the smallest number after the decimal point, that is the number which is furthest to the right. For example if the price of the EUR/USD was 1.2000 and then it moved to 1.2033, then the price would have moved by 33 pips.

Pips can effectively help traders to prevent losses. A trader will be keeping an eye on such price movements so as to decide accordingly whether he should buy or sell. small movements in the pips will be acceptable, but as the changes increase the trader will be more careful as it might lead to bigger moves in the near future.

The Pip is the standard value forex traders use. While it is a simple measure anyone can easily understand and follow, it is also useful in communicating in a standard manner and thus there won’t be any confusion.

Many often ask how much a pip is worth. The number is so small that one might be tempted to neglect its relevance, but that is surely not the way to go about it in the forex market. Typically the value of a pip is the value for the contract of a standard lot. This will have a notional value of 100,000.

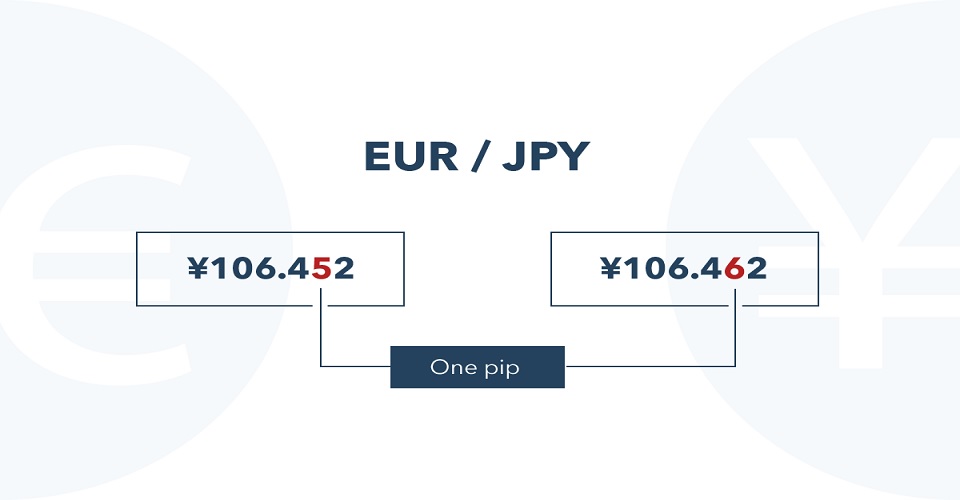

The pip is the move to the fourth decimal place for most currency pairs. In the case of pairs where the Japanese Yen is involved the pip would be the second decimal place.

There are two ways to calculate the Pip.

1. The calculation can be done by means of the price currency. This involves multiplying the amount that is going to be invested by the pip value.

2. The other way is the base currency. In this case you would have to divide the result of the base currency by the exchange rate in the market.

Hence the pip is the smallest increment in price at which a currency pair moves. The pip is the smallest number after the decimal point, that is the number which is furthest to the right. For example if the price of the EUR/USD was 1.2000 and then it moved to 1.2033, then the price would have moved by 33 pips.

Pips can effectively help traders to prevent losses. A trader will be keeping an eye on such price movements so as to decide accordingly whether he should buy or sell. small movements in the pips will be acceptable, but as the changes increase the trader will be more careful as it might lead to bigger moves in the near future.

The Pip is the standard value forex traders use. While it is a simple measure anyone can easily understand and follow, it is also useful in communicating in a standard manner and thus there won’t be any confusion.

Many often ask how much a pip is worth. The number is so small that one might be tempted to neglect its relevance, but that is surely not the way to go about it in the forex market. Typically the value of a pip is the value for the contract of a standard lot. This will have a notional value of 100,000.

The pip is the move to the fourth decimal place for most currency pairs. In the case of pairs where the Japanese Yen is involved the pip would be the second decimal place.

There are two ways to calculate the Pip.

1. The calculation can be done by means of the price currency. This involves multiplying the amount that is going to be invested by the pip value.

2. The other way is the base currency. In this case you would have to divide the result of the base currency by the exchange rate in the market.