Blog

What is Leverage in Forex?

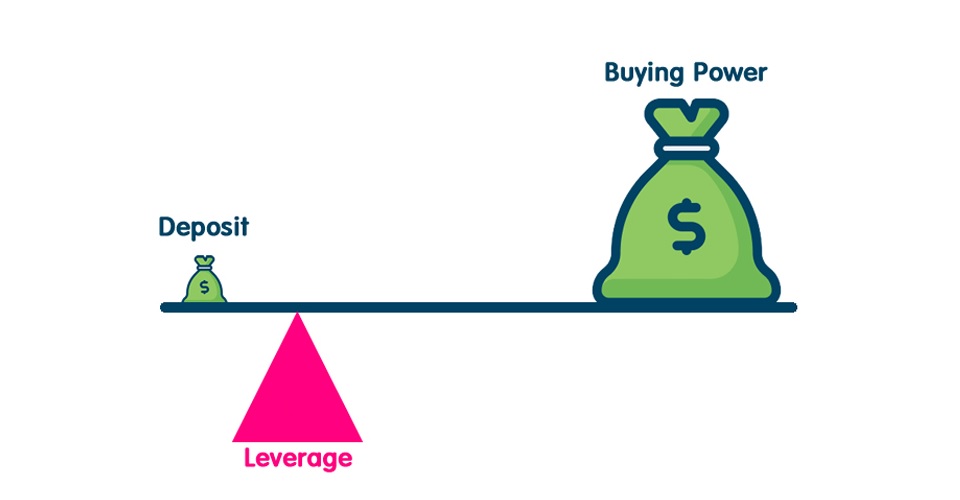

Leverage is a term which we tend to hear quite often, but many do not really know what it means. In its essence, leverage is actually a very powerful tool for traders. It can be used to make the most of minor price fluctuations. It can also be utilised to gain more exposure and better returns. If you use it well you can also manage to increase your profits significantly, and there is no need to invest huge sums of money either.

Trading with financial leverage should thus be your ultimate goal as a trader. This means that you would be trading with more money that disposable funds. Hence in order to be able to carry out transactions, the broker will be granting you a temporary loan. Then you will be trading with a position which is larger than the amount of funds in the account.

To express leverage generally a multiplier is used. This shows how many times the amount of the open position is vis-à-vis the actual amount of funds used by the trader for that position.

The main idea here is to utilise additional capital so as to buy more, with the expectation that the return on that trade will ultimately be greater than the cost involved in borrowing.

Having said that, it is important to be cautious. While leverage can indeed help a trader to increase potential returns, it will also be leading him to be more exposed to risks in trading. Hence it is recommended that leverage is used by experienced traders rather than those who are just starting out in forex.

Leverage offers various advantages. While the initial capital invested is minimised, you can still gain very well since it multiplies the profitability that can be ultimately attained from the particular transaction. Say you have just $100 capital, but you make a trade of $8,000. If the transaction achieves a return of 4% you will not be gaining $4 only (4% of $100), but $320 (4% of $8,000).

Leverage can be used in stocks, indices, crypto and forex. Leverage can generate impressive returns if used wisely and carefully. Otherwise, it could lead to serious problems. It is crucial that one ensures that careful research is carried out so as to utilise the best practices in a knowledgeable manner. Thus the importance of prudence and using a good strategy.

Trading with financial leverage should thus be your ultimate goal as a trader. This means that you would be trading with more money that disposable funds. Hence in order to be able to carry out transactions, the broker will be granting you a temporary loan. Then you will be trading with a position which is larger than the amount of funds in the account.

To express leverage generally a multiplier is used. This shows how many times the amount of the open position is vis-à-vis the actual amount of funds used by the trader for that position.

The main idea here is to utilise additional capital so as to buy more, with the expectation that the return on that trade will ultimately be greater than the cost involved in borrowing.

Having said that, it is important to be cautious. While leverage can indeed help a trader to increase potential returns, it will also be leading him to be more exposed to risks in trading. Hence it is recommended that leverage is used by experienced traders rather than those who are just starting out in forex.

Leverage offers various advantages. While the initial capital invested is minimised, you can still gain very well since it multiplies the profitability that can be ultimately attained from the particular transaction. Say you have just $100 capital, but you make a trade of $8,000. If the transaction achieves a return of 4% you will not be gaining $4 only (4% of $100), but $320 (4% of $8,000).

Leverage can be used in stocks, indices, crypto and forex. Leverage can generate impressive returns if used wisely and carefully. Otherwise, it could lead to serious problems. It is crucial that one ensures that careful research is carried out so as to utilise the best practices in a knowledgeable manner. Thus the importance of prudence and using a good strategy.