Blog

What is Pivot Points and how to use it?

In the currency markets there are countless factors that lead to changes. Global news which has an impact on trade, geopolitics, economic factors. Basically, anything that is monetary or fiscal in nature can have an impact to a greater or lesser extent. As a trader it may be a bit hard to keep track of all such elements, and this is where pivot points can be of help.

Indeed, a good way to measure the altitude relative to price events is by setting pivot points on a weekly basis. Price actions can take place at a higher or lower level as this will depend on the indicator being used, as well as the historical price action and other fundamental factors. Since there are several reference points and each of them is subject to change, it is increasingly demanding.

Hence as a trader you will need a reference point which is more dependable, or to a certain extent, fixed. In this manner you will be better able to adapt to fluctuations occurring. This is the reason why pivot points can be very helpful. Pivot points can help a trader to make better short term decisions. Let us delve a bit deeper into how they work.

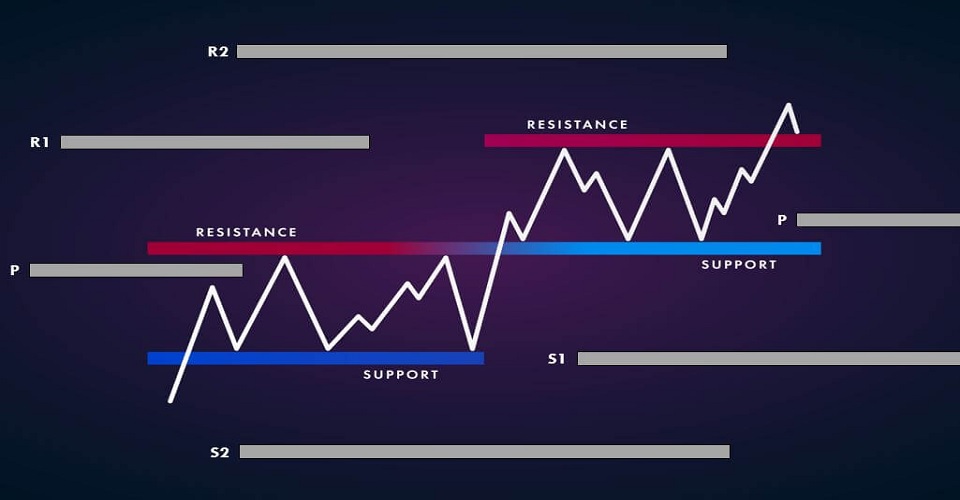

As already mentioned these are price levels which help traders establish the probable support and resistance levels. The two levels of support, often referred to as S1 and S2 will be used, along with a pivot point in the middle. This helps to show bullishness and bearishness. There will also be the R1 and R2, that is the two lines of resistance. Hence you will be able to establish whether there is a bullish or a bearish bias.

Pivot points are often described as being altitude measurement tools, as you can determine whether you are trading at a level that is too high or too low.

It is often recommended to set weekly pivot points as it is a better way to trade within a larger range of limits. There are various ways how one can interpret pivot points and make good use of them. The following are some common examples:

- You should look at the range of S2 to R2 as being overbought and oversold areas.

- It is helpful to check the S2 to R2 range of values on a regular basis, in order to be better able to consider levels of significance on a daily, weekly and monthly basis.

- It is helpful to check out the daily R1 and S1 levels.

- In most cases the whole week’s price action will tend to remain between the weekly R2 and S2.

- It is best to avoid going short when the price moves below the weekly S2, and also avoid going long when you notice the market is moving above the weekly R2 level.

Pivot points are great as reference points, and if you use them weekly you can be in a better position to measure the altitude of price action over the whole week. Since these points are fixed it is vital to monitor the wider context of both fundamental and technical elements so as to be better able to adjust accordingly.

Indeed, a good way to measure the altitude relative to price events is by setting pivot points on a weekly basis. Price actions can take place at a higher or lower level as this will depend on the indicator being used, as well as the historical price action and other fundamental factors. Since there are several reference points and each of them is subject to change, it is increasingly demanding.

Hence as a trader you will need a reference point which is more dependable, or to a certain extent, fixed. In this manner you will be better able to adapt to fluctuations occurring. This is the reason why pivot points can be very helpful. Pivot points can help a trader to make better short term decisions. Let us delve a bit deeper into how they work.

As already mentioned these are price levels which help traders establish the probable support and resistance levels. The two levels of support, often referred to as S1 and S2 will be used, along with a pivot point in the middle. This helps to show bullishness and bearishness. There will also be the R1 and R2, that is the two lines of resistance. Hence you will be able to establish whether there is a bullish or a bearish bias.

Pivot points are often described as being altitude measurement tools, as you can determine whether you are trading at a level that is too high or too low.

It is often recommended to set weekly pivot points as it is a better way to trade within a larger range of limits. There are various ways how one can interpret pivot points and make good use of them. The following are some common examples:

- You should look at the range of S2 to R2 as being overbought and oversold areas.

- It is helpful to check the S2 to R2 range of values on a regular basis, in order to be better able to consider levels of significance on a daily, weekly and monthly basis.

- It is helpful to check out the daily R1 and S1 levels.

- In most cases the whole week’s price action will tend to remain between the weekly R2 and S2.

- It is best to avoid going short when the price moves below the weekly S2, and also avoid going long when you notice the market is moving above the weekly R2 level.

Pivot points are great as reference points, and if you use them weekly you can be in a better position to measure the altitude of price action over the whole week. Since these points are fixed it is vital to monitor the wider context of both fundamental and technical elements so as to be better able to adjust accordingly.