Blog

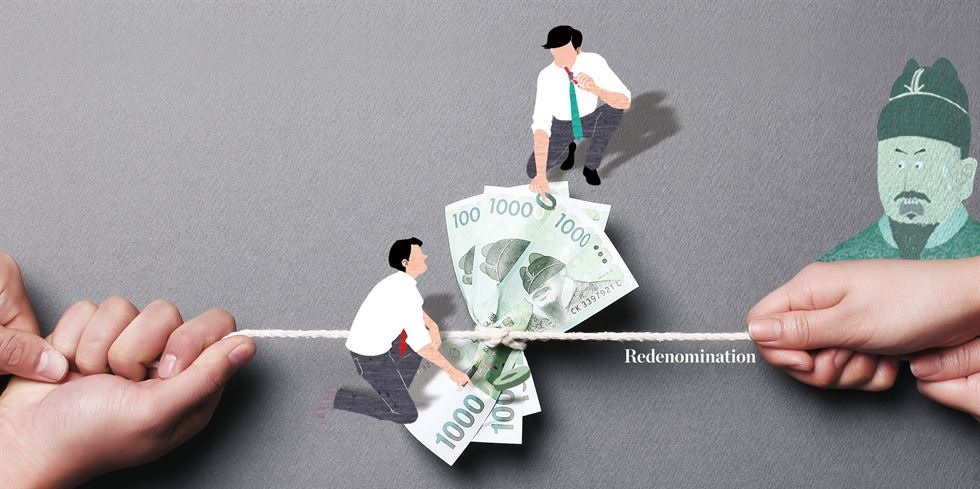

What is Redenomination?

Redenomination of currencies took place in various countries and in various periods. It refers to the reduction in the supply of a currency, with the main goal being to reduce or eliminate the effects of hyperinflation. This proportional substitution of the bills of a particular currency to bills of a lower denomination could offer room to make money if one acts at the right time. Besides this though, there are various other factors to consider, which we shall be discussing in more detail here.

Denomination is usually preceded by an imbalance in the national economy. Often there is a considerable prevalence of imports over exports, as well as a growth of the supply of money which is unjustified since it is not as a result of production. There is often a budget deficit and an increase in the public debt, generally accompanied by a high rate of unemployment which is growing. These situations tend to contribute to hyperinflation, that is uncontrolled increases in prices. In such cases the state may resort to issuing and this increase in the money supply tends to result in a new increase in the prices.

The most opportune moment for redenomination is in the initial stages of economic growth, particularly to help in the restructuring of the economy once hyperinflation has ceased. This is often ideally supplemented by raising awareness in the population. Indeed, redenomination is not considered to be an ideal solution unless it is accompanied by economic growth.

It may also lead to negative consequences, such as those related to rounding prices up, and people having to get used to using new monetary units. Adaptation is often psychologically demanding, not to mention the problems that could emerge during this transition period while people have to change the old bills.

It is important to point out that redenomination does not affect currency quotes and consequently one cannot earn money from it. Redenomination is all about the liquidation of an old currency accompanied by the emergence of a new currency. Hence the respective exchange rate shall depend on the effectiveness of the reforms which are implemented. Thus as an investor it is best to wait and see as it all depends on whether there will be economic growth, hyperinflation etc. Everything will still be quite dubious. On the other hand, for collectors, it could be possible to earn from redenomination.

At the end of the day redenomination is essentially an auxiliary tool that is sometimes used to improve the economy, particularly in cases when there is a crisis. The main aim remains to restore the confidence of the people in the national currency and also to simplify settlements. Redenomination is generally accompanied by a comprehensive program that has the goal for economic growth at its core.

Denomination is usually preceded by an imbalance in the national economy. Often there is a considerable prevalence of imports over exports, as well as a growth of the supply of money which is unjustified since it is not as a result of production. There is often a budget deficit and an increase in the public debt, generally accompanied by a high rate of unemployment which is growing. These situations tend to contribute to hyperinflation, that is uncontrolled increases in prices. In such cases the state may resort to issuing and this increase in the money supply tends to result in a new increase in the prices.

The most opportune moment for redenomination is in the initial stages of economic growth, particularly to help in the restructuring of the economy once hyperinflation has ceased. This is often ideally supplemented by raising awareness in the population. Indeed, redenomination is not considered to be an ideal solution unless it is accompanied by economic growth.

It may also lead to negative consequences, such as those related to rounding prices up, and people having to get used to using new monetary units. Adaptation is often psychologically demanding, not to mention the problems that could emerge during this transition period while people have to change the old bills.

It is important to point out that redenomination does not affect currency quotes and consequently one cannot earn money from it. Redenomination is all about the liquidation of an old currency accompanied by the emergence of a new currency. Hence the respective exchange rate shall depend on the effectiveness of the reforms which are implemented. Thus as an investor it is best to wait and see as it all depends on whether there will be economic growth, hyperinflation etc. Everything will still be quite dubious. On the other hand, for collectors, it could be possible to earn from redenomination.

At the end of the day redenomination is essentially an auxiliary tool that is sometimes used to improve the economy, particularly in cases when there is a crisis. The main aim remains to restore the confidence of the people in the national currency and also to simplify settlements. Redenomination is generally accompanied by a comprehensive program that has the goal for economic growth at its core.