Blog

Trading with Fundamental Analysis

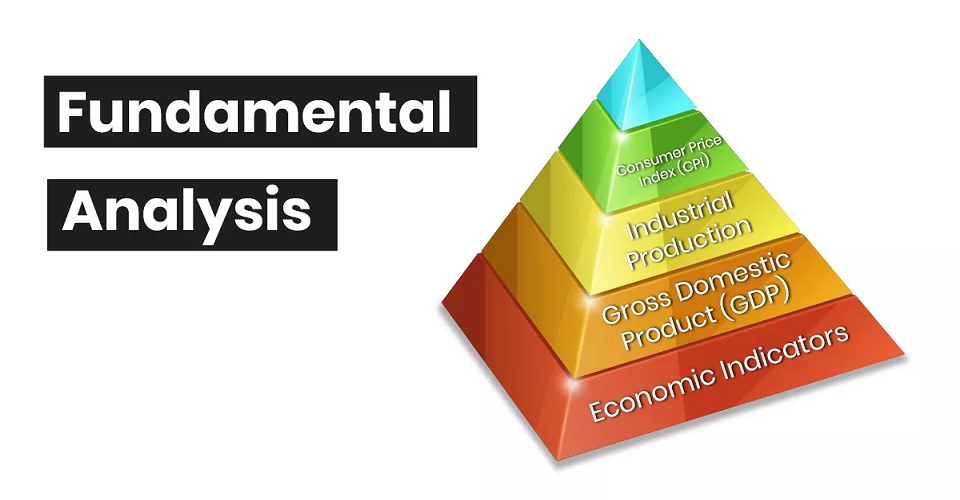

Fundamental analysis encompasses trading analysis which revolves around the influence of the forces of demand for and supply of currencies and commodities, according to global factors. Rather than focusing on chart patterns as technical analysis does, fundamental analysis is more involved in news and the forces of demand and supply. Having said that, both types are important and the majority of traders use both of them so as to make more well informed decisions.

Here are some important areas relating to fundamental analysis:

- Central banks – the actions taken by central banks are of great importance for fundamental analysis. This includes the lowering or raising of interest rates, any policies, revaluations of currency etc. It is a good idea to keep an eye on any news as well as any statements or speeches made by the central banks so as to predict any possible news.

- Economic releases – markets tend to move considerable following important economic releases. Since these are issued by experts in the field, most investors and traders have great faith in them. There is thus a consensus, which will lead the market to move in a particular direction. However should the actual result differ from what was predicted, other changes will occur. So you will need to be careful when considering what action to take, and when to act too.

- Geopolitical tensions – unfortunately such tensions are quite common, and they lead to various impacts on the market. Conflicts and wars and any tensions in the community need to be taken into account as they will often have an impact on the supply and demand.

- Seasonality factors – at certain times the market is more active, such as at the end of a month. This is referred to as month-end rebalancing whereby many businesses sell their products in various countries so as to offset currency hedges. Another occasion to consider is the end of the calendar year, where many investors decide to sell equities which had declined throughout the past year so as to claim capital losses on taxes. On the other hand in January several investors come back to certain equities.

Fundamental analysis is quite broad and there are so many factors to consider. Some are more long-lasting in nature, whereas others are more immediate. As a trader you need to be aware of the most important ones and their effects.

Here are some important areas relating to fundamental analysis:

- Central banks – the actions taken by central banks are of great importance for fundamental analysis. This includes the lowering or raising of interest rates, any policies, revaluations of currency etc. It is a good idea to keep an eye on any news as well as any statements or speeches made by the central banks so as to predict any possible news.

- Economic releases – markets tend to move considerable following important economic releases. Since these are issued by experts in the field, most investors and traders have great faith in them. There is thus a consensus, which will lead the market to move in a particular direction. However should the actual result differ from what was predicted, other changes will occur. So you will need to be careful when considering what action to take, and when to act too.

- Geopolitical tensions – unfortunately such tensions are quite common, and they lead to various impacts on the market. Conflicts and wars and any tensions in the community need to be taken into account as they will often have an impact on the supply and demand.

- Seasonality factors – at certain times the market is more active, such as at the end of a month. This is referred to as month-end rebalancing whereby many businesses sell their products in various countries so as to offset currency hedges. Another occasion to consider is the end of the calendar year, where many investors decide to sell equities which had declined throughout the past year so as to claim capital losses on taxes. On the other hand in January several investors come back to certain equities.

Fundamental analysis is quite broad and there are so many factors to consider. Some are more long-lasting in nature, whereas others are more immediate. As a trader you need to be aware of the most important ones and their effects.